- #QUICKBOOKS PAYROLL SERVICE CONTACT MANUAL#

- #QUICKBOOKS PAYROLL SERVICE CONTACT UPGRADE#

- #QUICKBOOKS PAYROLL SERVICE CONTACT FULL#

- #QUICKBOOKS PAYROLL SERVICE CONTACT SOFTWARE#

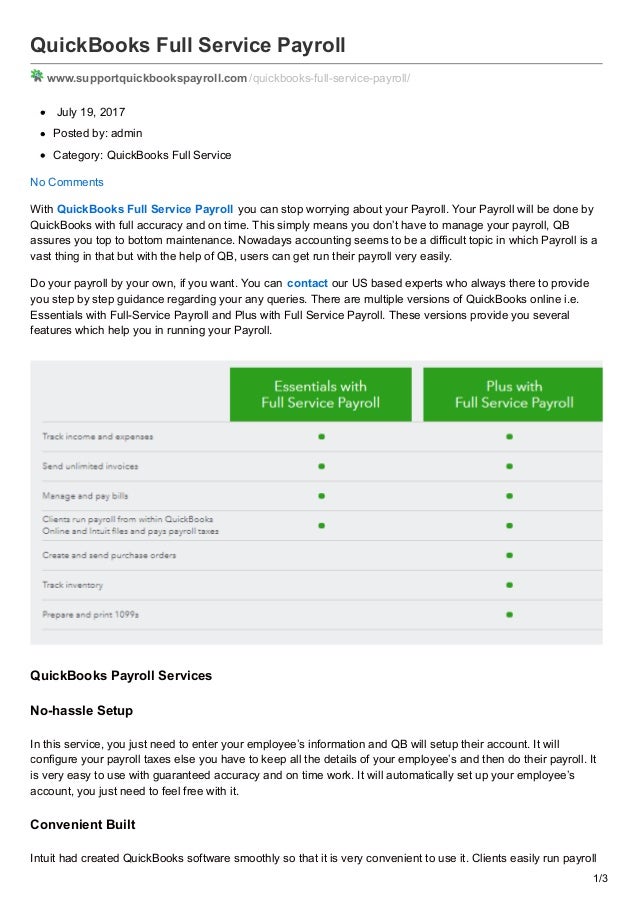

You pay this fee only for currently active employees and for independent contractors you paid in the month you are looking at.įeatures vary depending on which option you go for.

#QUICKBOOKS PAYROLL SERVICE CONTACT SOFTWARE#

You pay a base price to use the software and a per-employee, per-month fee on top of that. QuickBooks Payroll pricing comes in three different tiers.

#QUICKBOOKS PAYROLL SERVICE CONTACT FULL#

Being a recognized company, there are numerous free tutorials and other resources that users can use to make their user experience better and be able to use the service at its full potential. You can also lookup current tax rates and laws related to payroll for any state you desire. These include a payroll glossary for you to look up any unfamiliar terms and concepts and a paycheck calculator that takes into account all the factors, such as overtime, taxes, and more. In addition to all the features available under the plan you choose, you can have access to free tools that you and your employees can find useful as you do the payroll.

#QUICKBOOKS PAYROLL SERVICE CONTACT UPGRADE#

Clients can always upgrade or downgrade based on their needs. These include HR service where you can receive help from an HR advisor and access other resources, worker’s compensation, 401k plans, as well as an affordable health benefits package for your employees. There are numerous services that can be tied to the basic Intuit QuickBooks Payroll Service as you upgrade to a more advanced payroll plan.

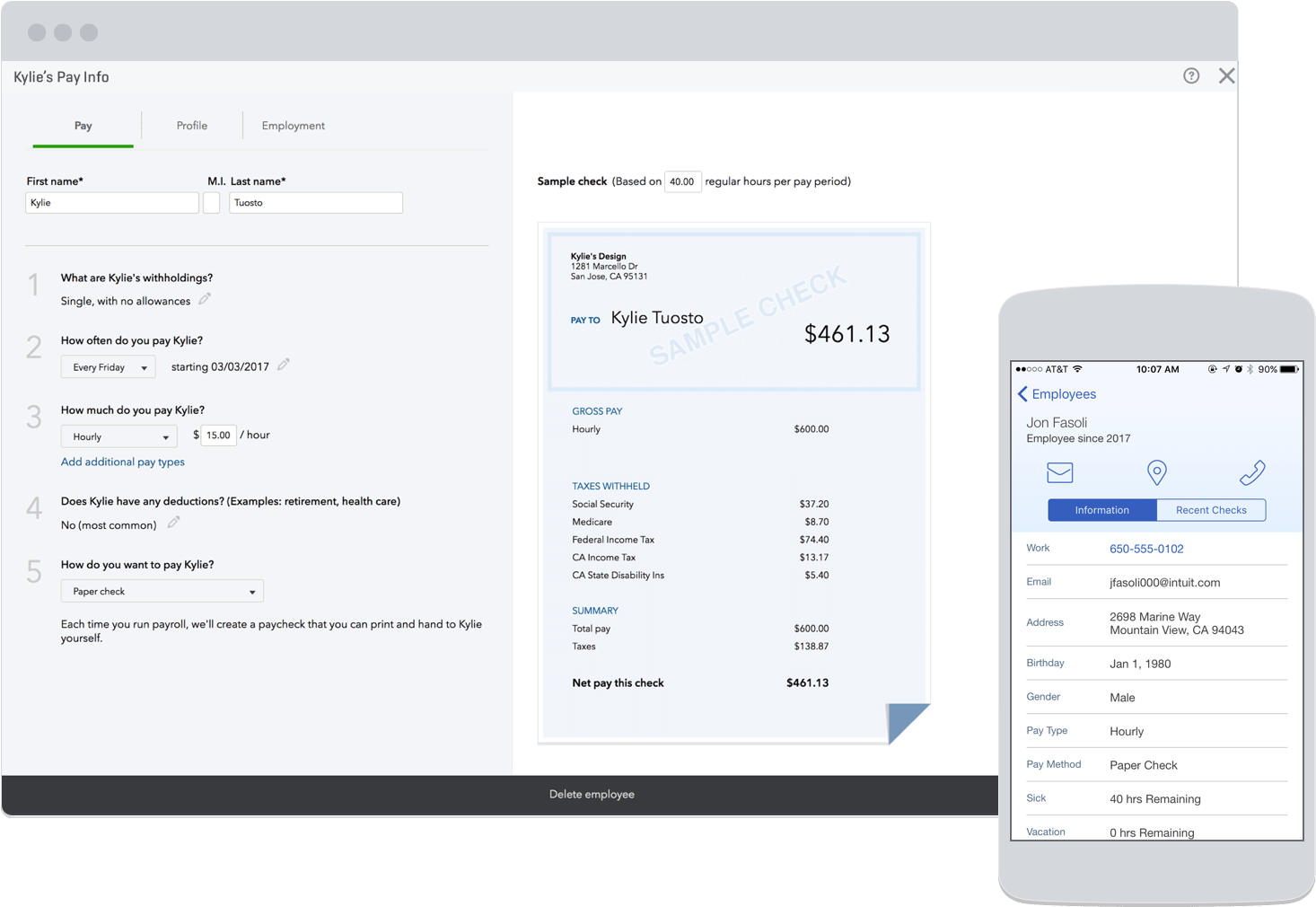

With the most advanced plan, a tax penalty protection feature is also included. With QuickBooks Payroll, clients get automated tax calculations for every paycheck, as well as federal and state tax filings and payments at the end of the year. If you do something wrong when running the payroll, you will end up owing a lot of taxes and penalties. For independent contractors, you would give them a check and issue 1099 at the end of the year. Running a payroll involves taking your employees’ gross pay and subtracting taxes, withholdings, and deductions. Of course, you can also choose to pay your employees with our personal or business check or print checks on blank or preprinted check stock. Not only does this keep cash in your business flow for as long as possible, but also ensures that your employees get paid on time every time. One of the important features we would like to bring up in this Intuit QuickBooks Payroll Review is the ability to use next-day or even same-day (with more advanced plans) direct deposits. Besides being able to pay part and full-time employees of your business, you can also have your independent workers paid with the help of Intuit QuickBooks Payroll. Moreover, you can run payroll as often as you like and there will be no additional charges if using an online version of this product. What attracts many to QuickBooks Payroll is an ability to run payroll in every state as well as an option to automize the payroll process.

#QUICKBOOKS PAYROLL SERVICE CONTACT MANUAL#

Running payroll is fairly straightforward and reduces manual work to a minimum. Intuit It provides a way for them to pay their employees easily, on time, and without much hassle. This service is made specifically for small businesses and comes with an impressive list of features. Today, we will would like to help you decide if their payroll service is something that would meet your business needs or if you should look elsewhere. QuickBooks is a very popular business solution. Are you an owner of a small business looking for a new payroll provider? Then, you would want to read this Intuit QuickBooks Payroll Review.

0 kommentar(er)

0 kommentar(er)